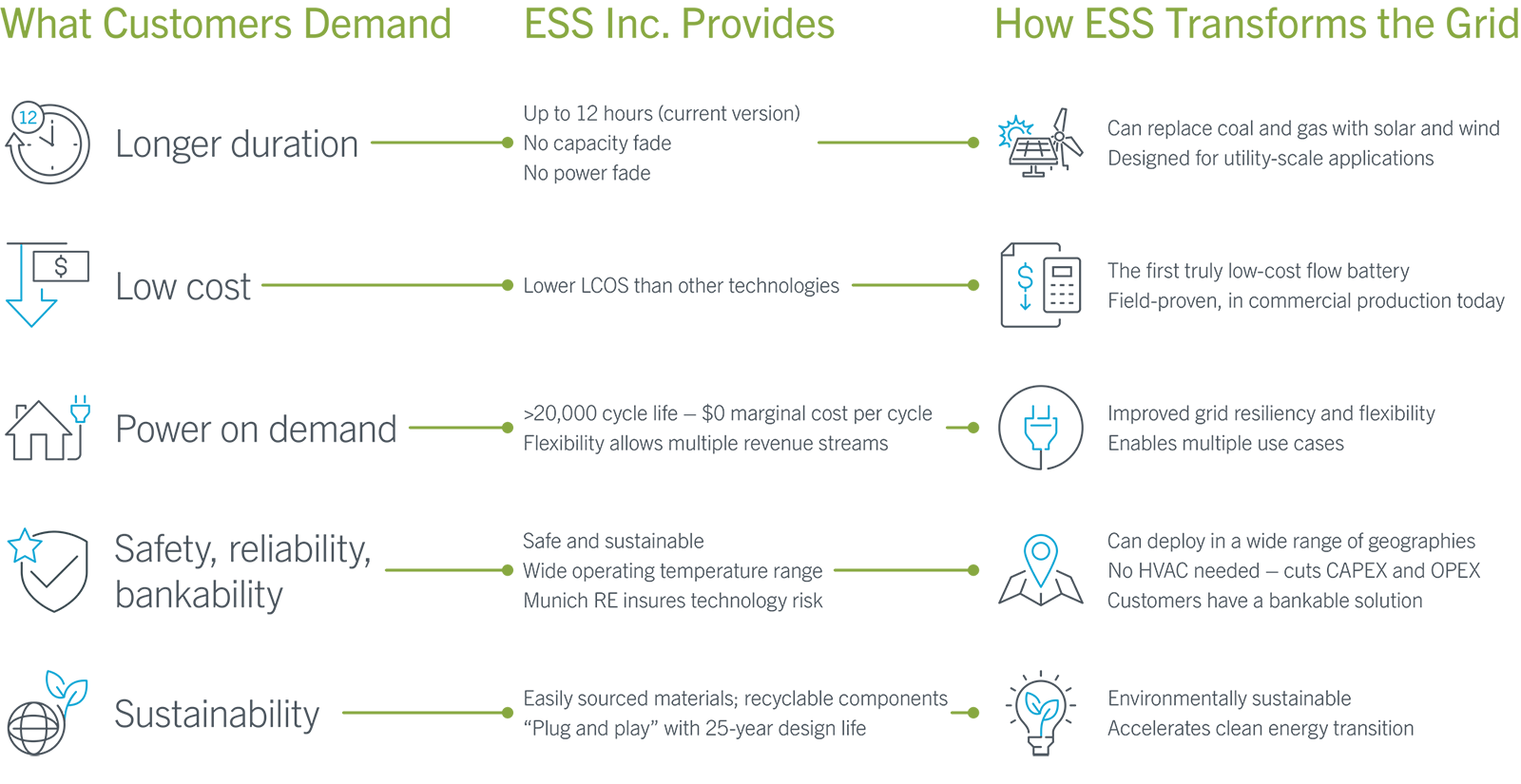

How We Stack Up

ESS transforms the value proposition for long-duration storage

ESS wins on performance, price, and sustainability

How can you utilize a battery designed for a 25-year operating life 24 hours a day?

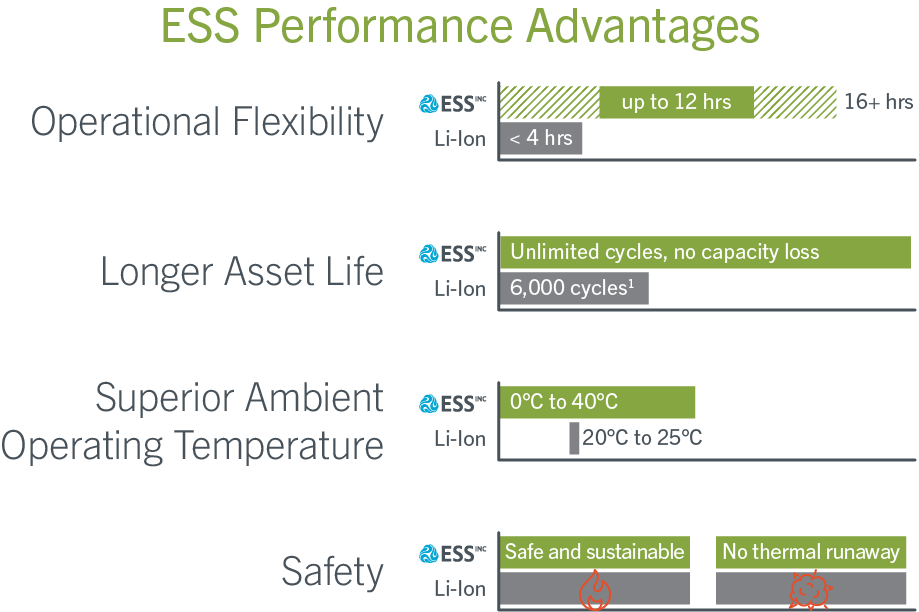

A battery doesn’t generate revenue or a return if it is sitting idle. With unlimited cycling and no capacity degradation, ESS iron flow technology maximizes revenue opportunities by not only providing long-duration energy storage, but also key grid ancillary services and serving peak demand periods. Without cycle limitations or capacity degradation, you can charge and discharge daily or even multiple times per day. Let us show you how to maximize the benefits and unique characteristics of our iron-flow battery storage solutions, the Energy Warehouse™ (EW), and the Energy Center™ (EC).

A typical lithium-ion battery use case includes four hours of charging, four hours of discharging and sitting idle for 16 hours a day. This is due to the limited cycle life and degradation in capacity inherent to the lithium-ion technology.

ESS technology offers unlimited cycling which means you never have to let your ESS system sit idle.

ESS technology makes it possible to stack multiple use cases and value streams for more than four hours of discharge and more than one cycle per day from a single battery asset. No future capacity augmentation is required and the more you use the battery, the greater your ROI on your ESS battery asset.

ESS solutions are designed for a 25-year operating life, which aligns with typical IPP and utility wind and solar project lifespans of 25+ years. This results in a significantly lower cost of delivered energy over the life of the project compared to alternatives.

The ESS cost and performance advantage

The economic viability of many projects is enhanced when an additional cycle is added. The cost of ownership of an ESS iron flow battery system can be up to 40% less than competing technologies over a 25 year project life due to no capacity degradation, no need for HVAC, and a lower OpEX than Li-ion systems.

Can cycle when needed with no impact on asset life.

Operates at peak efficiency independent of ambient temperature.

No heating/cooling systems required.

Safe for deployment in urban areas or harsh and pristine environments.

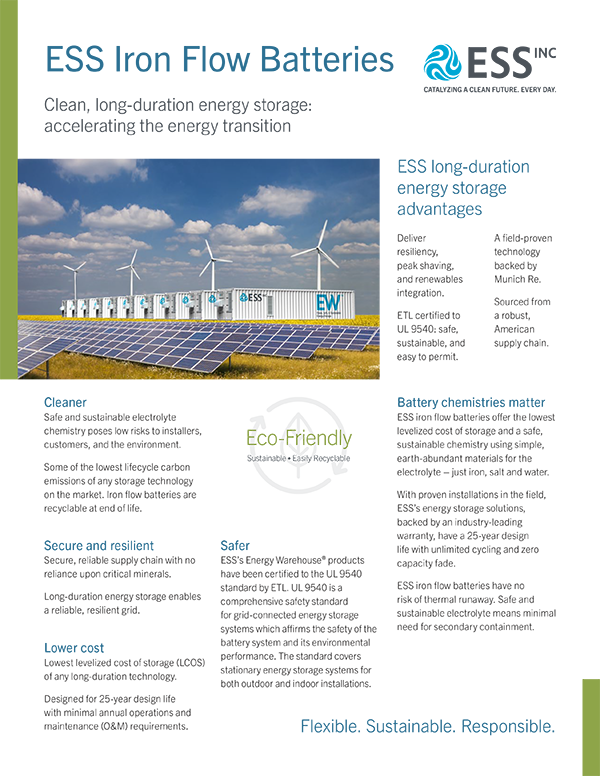

ESS wins on sustainability

Earth abundant materials: raw ingredients are iron, salt and water.

Lowest cradle-to-gate global warming potential (GWP): one-third the embodied CO2 emissions of lithium-ion batteries.

Recyclability: contains safe and sustainable materials, and is fully recyclable at end of life.

Global warming potential

In collaboration with UC-Irvine, a Lifecycle Analysis (LCA) was performed on the ESS Energy Warehouse™ iron-flow battery (IFB) system and compared to vanadium redox flow batteries (VRFB), zinc bromine flow batteries (ZBFB) and lithium-ion technologies. Researchers assessed the manufacturing, use and end-of-life phases of the battery lifecycle. Their findings were clear:

Iron flow batteries proved to be the cleanest technology with the lowest global warming potential (GWP).

ESS wins on bankability: The only insured battery in its class

ESS has partnered with Munich Re to launch an industry first insurance cover for ESS iron flow batteries. This industry-leading policy means our long-duration energy storage solutions are backed by a 10-year performance warranty regardless of project size or location. ESS has also collaborated with Munich Re to develop a separate Project Cover to ensure a bankable product offering. The Cover directly offers more comprehensive coverage and can be extended in order to provide long-term assurance of project performance to system owners and financiers.

Investment-grade warranty

10-yr extended warranty covering battery modules

Investment-grade project insurance

Warranty continuity insurance provides additional surety to customers and financiers

US export-import bank qualified

Pre-qualified financing available for overseas buyers

Qualified Projects deployed during the Policy Period of Jan. 1, 2023 – Dec. 31, 2023 can obtain additional warranty back-stop by Munich Re, with insurance capacity exclusively allocated at project level.

"/>

"/>